The Pension Lifetime Allowance - What is it and how does it work?

Wednesday 26th May, 2021

The Lifetime Allowance is a limit on the amount of pension benefit that can be accrued by an individual across all pension schemes during their lifetime. How and when it is applied has continued to create confusion, and the potential for substantial charges for exceeding the Lifetime Allowance threshold has created a great deal of fear amongst anybody approaching this cap on pension accrual.

This brief guide will explain what the Lifetime Allowance is, how pensions are valued for Lifetime Allowance purposes, when the test is applied and how the Lifetime Allowance charge is calculated.

What is the pension Lifetime Allowance and how does it work?

The Lifetime Allowance (LTA) is a vexatious and often confusing restriction on pension benefits, which seems to frequently mystify both pension members and advisers alike. It was introduced in April 2006, as part of the so-called “pension simplification” a phrase that is a testament to the British sense of humour. Since then, it has undergone changes in 2012,2014 and 2016. In the next few paragraphs, I will try and explain some of its nuances and hopefully bring some clarity to the subject. If, after reading this, you feel no better informed, don’t be alarmed and rest easy in the fact that you are not alone. Simply pick up the phone and give me a call and I am happy to explain further.

In previous years, the LTA was generally a problem that affected a small minority or retirees. Not that many people built up a pension pot large enough to get within kicking distance of the LTA Threshold. However, the LTA has been reduced a number of times over the last decade or so, and the number of people impacted has gradually increased. Research by Royal London (Lifetime Allowance timebomb' set to hit more than a million workers) in 2019 found that 290,000 workers had already breached the Lifetime Allowance and over 1 million workers were at risk of breaching the threshold by the time they retire. With the freezing of the Lifetime Allowance until April 2026, this number is bound to increase.

Most people encounter the LTA for the first time when it comes time to take their pensions. The LTA is the maximum amount of pension benefit you can build up across all your schemes. This includes both Defined Benefit (DB) and Defined Contribution (DC) schemes. The standard LTA is currently £1,073,100. As mentioned above, this is set to be the level for quite a number of years. This is because the massive government spending to lessen the impact of COVID 19 resulted in the Chancellor freezing the LTA at this level until 5th April 2026, in an attempt to swell government coffers.

How to calculate the value of a Final Salary Pension for Lifetime Allowance purposes

The value of a defined Benefit (DB) scheme for LTA purposes is calculated by multiplying the income on offer by 20. This means that a DB pension scheme offering an income of over £53,655 (£53,655 x 20 = £1,073,700) per annum, will trigger an LTA charge. The charge will be paid by the scheme and the income on offer from the scheme will be reduced to reflect this.

Now, most DB schemes offer the option to take a tax-free lump sum from the pension. If the pension member accepts the tax-free lump sum, the income on offer will be reduced accordingly. However, it is important to remember that the tax-free lump sum still needs to be included in the amount tested against the LTA when the pension is taken.

Therefore, if Mr. Smith receives a tax-free lump sum of £200,000 and a reduced income of £50,000 per annum, the amount that will be tested against the LTA will be £1,200,000 ((£50,000 x 20) + £200,000). Taking the tax-free lump sum can either reduce or increase the size of the pension benefits to be tested against the LTA, depending on the commutation figure used by the scheme.

There are also other factors to take into consideration, so it is important to take some advice when dealing with a DB pension, particularly if your accumulated pension benefits take you close to the LTA.

How to calculate the value of a Defined Contribution (DC) Pension for Lifetime Allowance purposes

The value of the DC pension is far more straight forward and is determined by the monetary value of the accumulated pension being crystallised at the time the withdrawal is being made from the pension.

Now, as will be explained later, when you take (crystallise) your pension benefits, it is only the amount that is crystallised that gets tested against the Lifetime Allowance.

This offers an element of control to the pension member as to when they trigger the LTA charge.

What triggers a test against the Lifetime Allowance?

When you take your pension benefits, this is known as crystallising the pension. There are a number of other crystallisation events which may trigger a test of benefits against the LTA, including death and reaching the age of 75. If you crystallise more than your available LTA, the excess over the limit will be subject to tax at:

- 25% if you leave the excess in the pension, as pension benefits. However, you remain liable for income tax on any income received after the 25% charge is paid

- 55% if you withdraw the excess as a lump sum

Many people make the mistake of thinking that the LTA charge is triggered automatically when the LTA is exceeded. This is not actually the case, and the LTA charge is only triggered when the benefits in excess over the LTA are crystallised. Pensions can be crystallised incrementally, with crystallised and uncrystallised pension benefits residing together in the same pension wrapper.

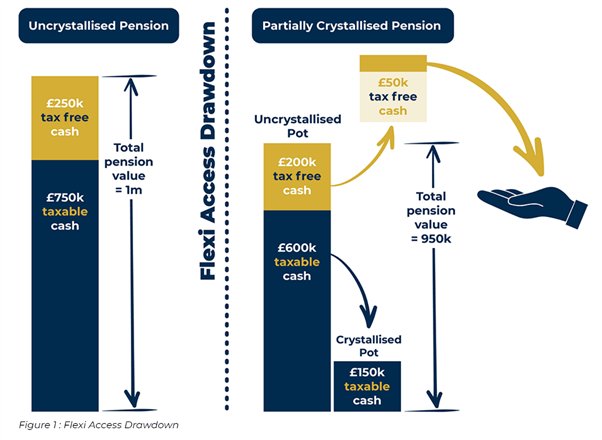

This is demonstrated in the diagram below. As you can see, prior to crystallisation the pension member has a total pension of £1,000,000. Of this, £250,000 (or 25% of £1m) can be taken as a tax-free lump sum. The member decides that they want to withdraw £50,000 as a tax-free lump sum. In order to do this, they need to crystallise £200,000 of their pension (£200,000 x 25% = £50,000). The £50,000 is paid out to the member as a tax-free lump sum. The remaining £150,000 of the now crystallised pension pot remains within the pension, alongside the remaining £800,000 uncrystallised pot (of which £200,000 can still be taken as a tax-free lump sum).

A partially crystallised pension

It is therefore possible to delay triggering the LTA, by crystallising all your pension up to the available limit and leaving the excess uncrystallised.

For example, Mrs. Smith has a pension worth £1,500,000. She does not wish to immediately trigger the LTA charge, so she crystallises £1,073,100 of her pension, leaving the excess over this limit (£426,900) uncrystallised. As the excess over the LTA has not been crystallised, it will not trigger an immediate LTA charge.

It is important to note that this is only a temporary solution. When Mrs. Smith turns 75, the remaining pension will be automatically crystallised, resulting in an LTA charge. The reason for this is that age 75 is a benefit crystallization event (as mentioned above), so when the member reaches this age, the full pension will be crystallised and tested against the LTA.

This is an irritating pension restriction, which is complex and hard to fathom. However, there are possible options available to enhance and protect your personal LTA. These currently include:

- Individual Protection 2016 – which may be available if your pension was greater than £1m at 05/04/2016. This will fix your Lifetime Allowance at the lower of £1,250,000 OR the value of your pension benefits at 5 April 2016. If you use this protection you can still make contributions to your pension.

- Fixed Protection 2016 – which will allow you to fix your LTA at £1,250,000 provided you haven’t made any pension contributions since 06/04/2016. If you apply for this protection, you will not be allowed to make further contributions to your pension. If you do, it will invalidate the protection.

There are also other protected Lifetime Allowances which were offered to pension members to protect their pension benefits from impending reductions or changes to the LTA, but are no longer available. These include:

- Primary Protection (available until 5 April 2009)

- Enhanced Protection (available until 5 April 2009)

- Fixed protection 2012 (available until 5 April 2012) fixing the LTA at £1.8m

- Fixed protection 2014 (available until 5 April 2014) fixing the LTA at £1.5m

- Individual protection 2014 (available until 5 April 2017) equal to the value of the pension rights on 5 April 2014, if more than £1.25m and capped at £1.5m.

If you registered for any of these protections, it is worth taking some financial advice, before you take your pension benefits, or make any contributions to your pensions that may result in the protection being lost.

It is also important to note that it is possible to fully encash up to 3 small pension pots (each below £10,000) and, subject to the small pot rules, these will not be included in any test against the LTA. In the more fluid job market we work in nowadays, where an employee may build up numerous small pensions, this may be an advantage when trying to mitigate some of the impact of the LTA.

As you can see, this is a particularly complex area and can result in fairly substantial tax charges if not dealt with properly. It is therefore very important to take some advice when considering the impact of any LTA charge and how to deal with it.

You can watch our video on the Lifetime Allowance by following the link: The Pension Lifetime Allowance or give us a call on 01420446777.