The impact of fees and charges on investment returns - active versus passive investment

Sunday 6th June, 2021

I am often asked by investors, "Am I paying too much for my investments?".

So, what is the impact of costs on your investments and does it matter? The answer to this question is far more nuanced than many realise and really depends on what your personal preferences and beliefs are, and what you are trying to achieve. It also invariably involves a comparison of active versus passive investment. In the article below, I will firstly highlight the impact of costs on investment returns over time, underlining the importance of this subject. I will then explain the difference between active and passive investment strategies. Lastly, I will endeavour to explain our reasons for favouring passive investment strategies for generating investment growth and returns.

The impact of cost on investment returns – passive versus active management

I meet many investors who are paying upwards of 2% - 2.6% per year in ongoing fees and investment charges each year. When I speak to them about it, they are not overly perturbed. They feel that 2.5% doesn’t sound like much, especially when their wealth manager has generated 6% per year (after charges) for the last 10 – 20 years.

Now, that is a really good return and I am not one of those people who believe that you shouldn’t pay for investment management and financial advice. However, I do think it is important to understand the impact of the charges you are paying.

To put it into perspective, imagine that you invest £100,000 and you receive 6% per annum for the next 25 years. If you had no fees on the investment whatsoever, you would end up with approximately £430,000. Now, if you add in annual investment charges of 2%, that reduces the value after 25 years to £260,000. In other words, the 2% you are paying each year would wipe out almost 40% of your value. (Vanguard – Don’t let high costs eat away your returns)

The reason for this dramatic impact is that the charges compound up over time. You see, you are not just losing the amount you pay in fees, but also the returns you would have generated had that money remained invested.

As I mentioned earlier, we really do believe in the benefit of financial advice for building your investment portfolio and planning for your future. At Atticus Financial Planning we try to adopt an empirical approach to all the decisions we make. Research carried out by Numis Securities (Daniela Esnerova, Value of advice put at 2% as SJP returns top Hargreaves, FT Adviser, 24/09/2020) demonstrates that taking financial advice added on average 2% to an advised portfolio after costs, compared to a DIY investor portfolio. The most important thing to note about this analysis, is that it took into consideration both portfolio returns and costs. The Numis report is not a standalone piece of research and is supported by numerous studies that show the benefit of taking advice on investor wellbeing and overall returns. So, wealth managers and financial advisers must be doing something right.

However, as investment professionals, we always need to be on the lookout for the things we can do to generate better returns for our clients. We accept that we cannot control the movements of the market, so we must look to those things we can control, such as costs and asset allocations, to provide improved outcomes from our services. With this in mind, I think it makes sense to ask the question: How much is being spent in fees and charges on the investments in a portfolio and is it worth it?

Active versus passive investment strategies

In any discussion about the costs of investing, you will inevitably stumble into the debate on active fund management versus passive fund management.

Actively managed funds

Actively managed funds are those that have a fund manager who makes all the investment decisions. You pay a charge (normally a percentage of the fund value) for the fund manager in the hope that their decisions will increase the returns that you achieve. You can think of the fund manager as a very well-paid prospector, mining away to find you companies and opportunities to invest in that will give you a return that is better than the market average.

For example, an active fund manager with a mandate to invest in companies on the FTSE 100, will not invest in all 100 companies on the index. Rather, they will look through the fundamentals of each company and consider their prospects, in order to pick 20 or 30 to invest in, with the hope of excluding poorly performing companies and thus providing a better return than the FTSE 100 itself.

There are many benefits to actively managed funds. However, there are also many difficulties and obstacles placed in the way of the manager.

The main obstacle is restrictions placed on the fund manager in terms of the maximum size of the holdings the fund can have in one company. In order to ensure diversification and reduce risk, active fund managers cannot invest more than a certain percentage into a particular company. This makes it harder for the fund manager to produce good returns, as they have to find more opportunities to invest in that will hopefully perform well and it forces the fund manager to dilute their convictions.

This is a particular problem for investment funds that have become bigger due to their success. The more money that flows into the fund and the bigger it becomes, the harder it is to generate positive returns. The manager has to generate far more upside to move the dial on a £1bn fund than they do on a £200m fund.

Passively managed funds

The other kind of fund is a tracker fund that tracks the performance of a particular index such as the FTSE All Share Index or the Dow Jones Industrial Average.

An index simply provides you with the average performance of the components of that index. The FTSE 100 index provides you with a return based on the average performance of the 100 largest companies in the UK by market capitalisation. The Dow Jones Industrial Average is a stock market index that measures the stock performance of 30 large companies listed on stock exchanges in the United States. A gold index tracker may provide you with a return based on tracking the gold price.

There is no end to the types of indices out there that track the price movement of gold, coal, agriculture as well as the more standard stock market indices.

There is also no need for a fund manager, as the components of the index are already predetermined and are dictated by the parameters of the index and movements in the particular market or commodity. These are therefore known as passively managed funds, as they simply give you the performance of the market.

As they don’t have a fund management team picking stocks, they have much lower charges.

Passive fund management is by no means perfect. One of the biggest problems faced by passive funds is how to replicate the index accurately. There are various approaches, with full replication being most accurate, as it aims to fully replicate the make-up of the index.

Stratified sampling is a more approximate approach whereby the assets in an index are divided into several categories. For each category, representative assets are selected into the tracking portfolio according to a set of rules. This provides an approximate representation of the performance of a particular index.

There are also various computer modelling approaches, sometimes referred to as optimisation.

With all these different approaches to modelling the performance of a particular index, there is the possibility that some methods will be less accurate than others. This may result in tracking error, where the performance of the fund does not exactly replicate the performance of the index.

Furthermore, even though the charges are generally far lower on a passive fund, there are still charges. These will automatically reduce the returns achieved, so they will naturally be slightly below that of the index.

At Atticus Financial Planning we generally favour portfolios created with passively managed funds over actively managed funds for the following reasons:

- Most fund managers don’t outperform their index or benchmark over the medium to long term. This is born out by looking at the 5/10-year performances of various regional funds as documented by the SPIVA report which shows:

- 75.17% of European Equity funds underperformed their index over 5 years

- 65% U.K.-focused equity funds underperformed their index over 10 years. However, it is important to note that UK active funds performed relatively better than other regions over short terms

- In the US 75.27% large-cap funds underperformed the S&P 500 over 5 years, with 65.12% of small-cap funds underperforming over a similar period

- In Canada 98.63% of Canada focussed equity funds underperformed their index over 5 years

- In India there was an 80.43% underperformance over 5 years by equity funds and in Brazil an 80.37% under performance by equity funds over 5 years. This flies in the face of the belief that fund managers offer better returns in inefficient markets

- Bond fund performances were also poor when compared to their indexes

- (All figures above are taken from the SPIVA 2020 end of year reports)

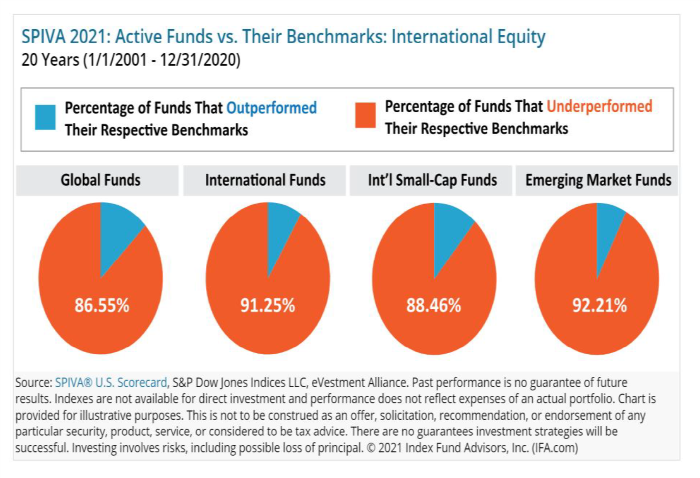

- The assertion that most fund managers underperform against their benchmark is further evidenced in the chart below:

The SPIVA chart shows the performance of international equity funds over the last 20 years relative to their benchmarks.The key takeaway for me from this information is simply this. There are without a doubt investment funds that outperform their index over time. However, the vast majority don’t. So, how do you manage to sort out which are the ones you can trust and, year on year, justify their higher costs. Peter Lynch (acknowledged as one of the greatest fund managers that ever lived, after managing the incredibly successful Fidelity Magellan fund for a number of years) recommends that the average investor would be better off in a tracker fund. He is supported in this view by the sage of Omaha, Warren Buffett.

The SPIVA chart shows the performance of international equity funds over the last 20 years relative to their benchmarks.The key takeaway for me from this information is simply this. There are without a doubt investment funds that outperform their index over time. However, the vast majority don’t. So, how do you manage to sort out which are the ones you can trust and, year on year, justify their higher costs. Peter Lynch (acknowledged as one of the greatest fund managers that ever lived, after managing the incredibly successful Fidelity Magellan fund for a number of years) recommends that the average investor would be better off in a tracker fund. He is supported in this view by the sage of Omaha, Warren Buffett.

- Separate studies by Gary Brinson and Roger G. Ibbotson show that that over 90% of a portfolio’s return is derived from overall asset allocation (proportion in shares, gilts, property, geographical regions, specific industries etc.) rather than stock selection or market timing. What they are in effect arguing here is that actual stock picking and seeking out of investment opportunities and undiscovered market gems by fund managers does not really generate sufficient excess return to warrant their additional costs.

- However, the main reason we favour passive investments is because of their lower costs. When you consider all the evidence above, that demonatrates that most active investment managers do not outperform their benchmark/index over the medium to long term, then investing into something that provides us with the approximate average at a lower cost makes absolute sense. Passive investment funds allow us to build a very well diversified portfolio, aligned with a specific strategic asset allocation, while allowing us to keep a tight control on costs.

- The charges you are paying on your investments become even more important when you start to withdraw funds from your investments and pensions to pay for retirement. Wade Pfau estimated that the safe withdrawal rate (the rate at which an investor can erode their capital to meet living costs at a ‘safe’ pace – see “What are my retirement options”) is about 3.05% per year. However, this is not adjusted for fees. If fees are included, the safe withdrawal rate falls to between 2% and 2.6% per annum. It therefore becomes paramount in retirement to keep fees under control.

Now, we understand that not everyone agrees with us. We also accept that there are certain niche markets and circumstances where fund managers offer real value. For example, with Venture Capital Trusts (VCTs) and Enterprise Investment Schemes (EIS) there is a need for in depth analysis of investment opportunities, as investment is being made into incredibly new companies with high growth potential and also high risk of failure. A human element is necessary in this type of investment management to assess the prospects of a start-up’s success. Here the investment managers provide experience and analytical skill that makes the difference between success and failure.

In addition to this, when looking for investments that provide high levels of natural income or equity income, there is a strong argument for fund managers who can assess the stability of a particular holding and its ongoing dividend yield.

There are also niche funds that invest in the care sector or purchasing freehold ground rent or infrastructure projects. There is a huge human element required in spotting opportunities and successfully negotiating their acquisition.

Passive ESG Funds

An unexpected turn of events seems to be the encroachment of passive funds into the sustainable investment space. Sustainable or so-called ESG (Environmental, Social and Governance) funds has long been regarded as the preserve of active managers. However, research carried out by Morningstar (Europe) in 2018 found that passive ESG funds had beaten active ESG funds (Behind the numbers: How passive ESG funds really fare against their active rivals, Hortense Bioy, October 2018). This was due, in part, to their very low cost. Passive ESG funds were found to be on average three times cheaper than their active alternatives.

Final thoughts

At the end of the day, your investment portfolio needs to reflect your personal approach to investment. If you feel most comfortable with active investment and the possibility of above average returns this offers, then this is the approach you should adopt. This does not prevent you from still being cost aware. There are many active fund managers who have taken on board the fact that investment costs can have a dramatic impact on the overall returns received by investors and have taken steps to reduce their fees to make provision for this.

You can therefore still keep your eyes open for great active investment management at a lower cost.

However, the impact of charges on the end result cannot be denied and it is therefore crucial that cost management form a key part of your investment strategy.